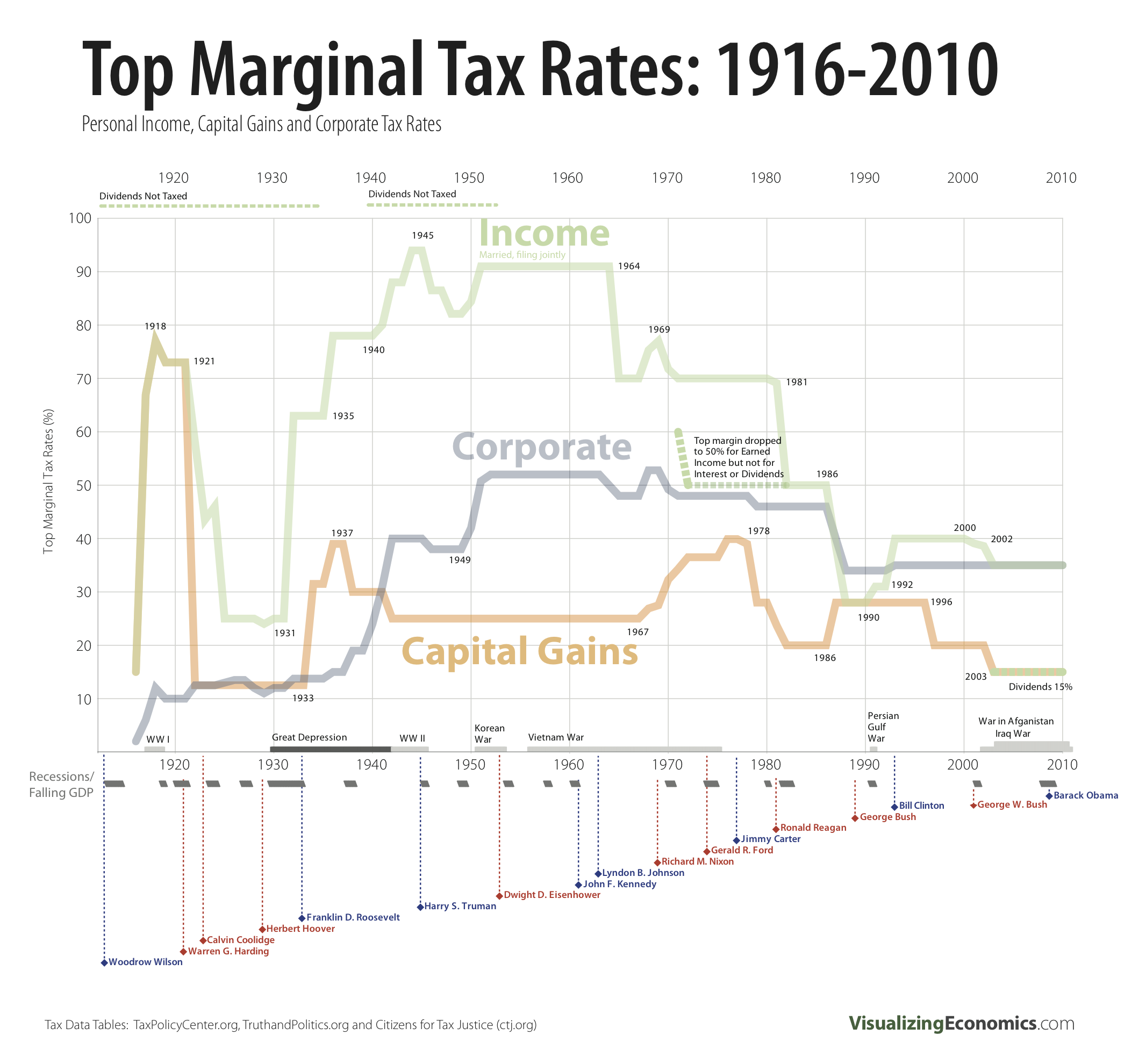

The top tax rate has been cut six times since 1980 — usually with Democrats' help - The Washington Post

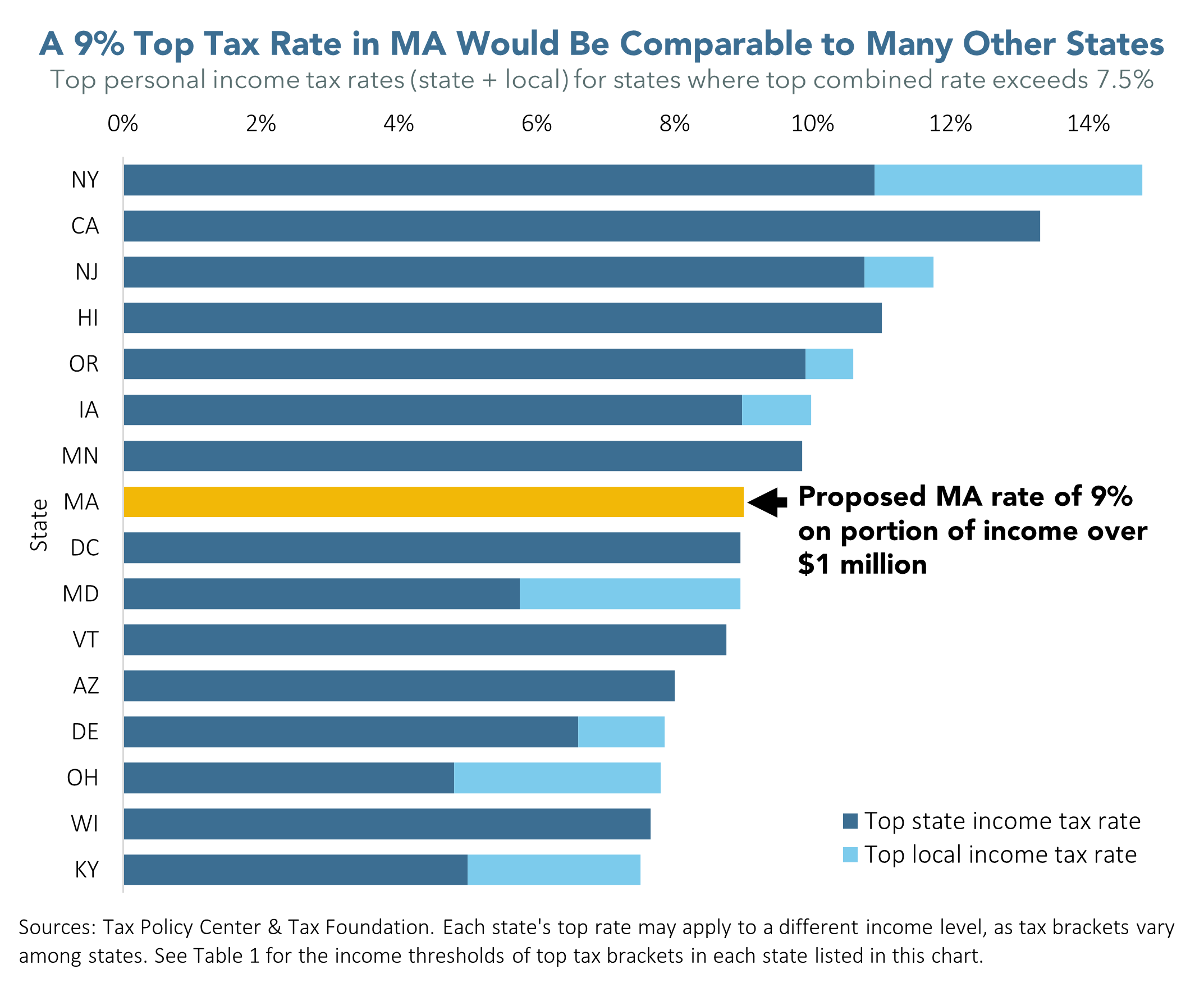

With “Millionaire Tax,” Massachusetts' Top Tax Rate Would Compare Well to Top Rates in Other States - Mass. Budget and Policy Center

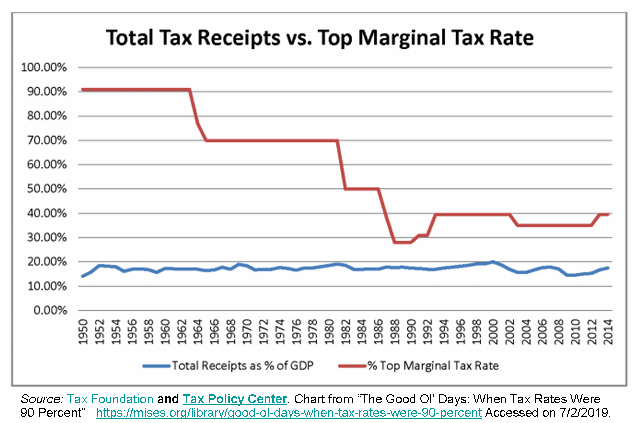

Chart of the Day: The Inverse Relationship Between the Top Marginal Income Tax Rate and the Tax Burden on 'the Rich' | American Enterprise Institute - AEI

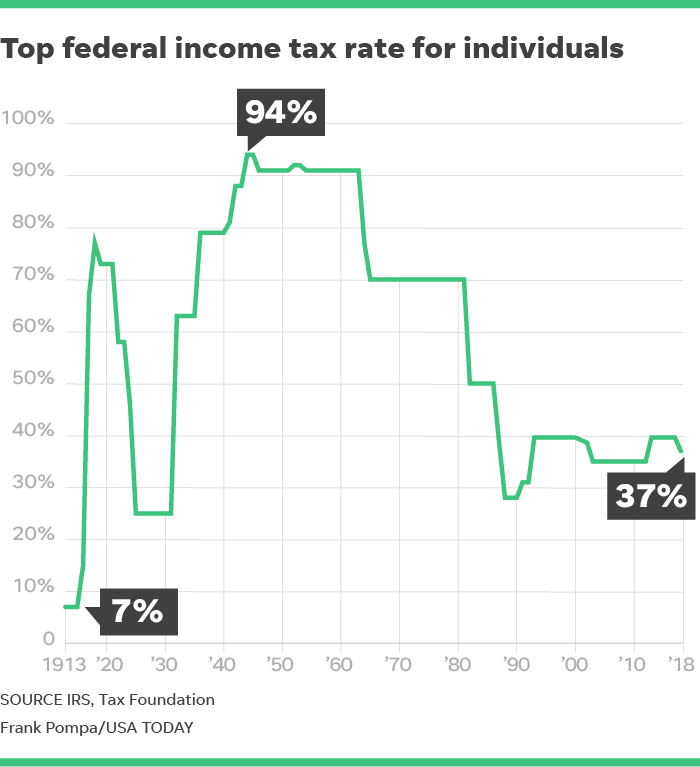

History of top marginal tax rates in the US. Source: US Joint Committee... | Download Scientific Diagram